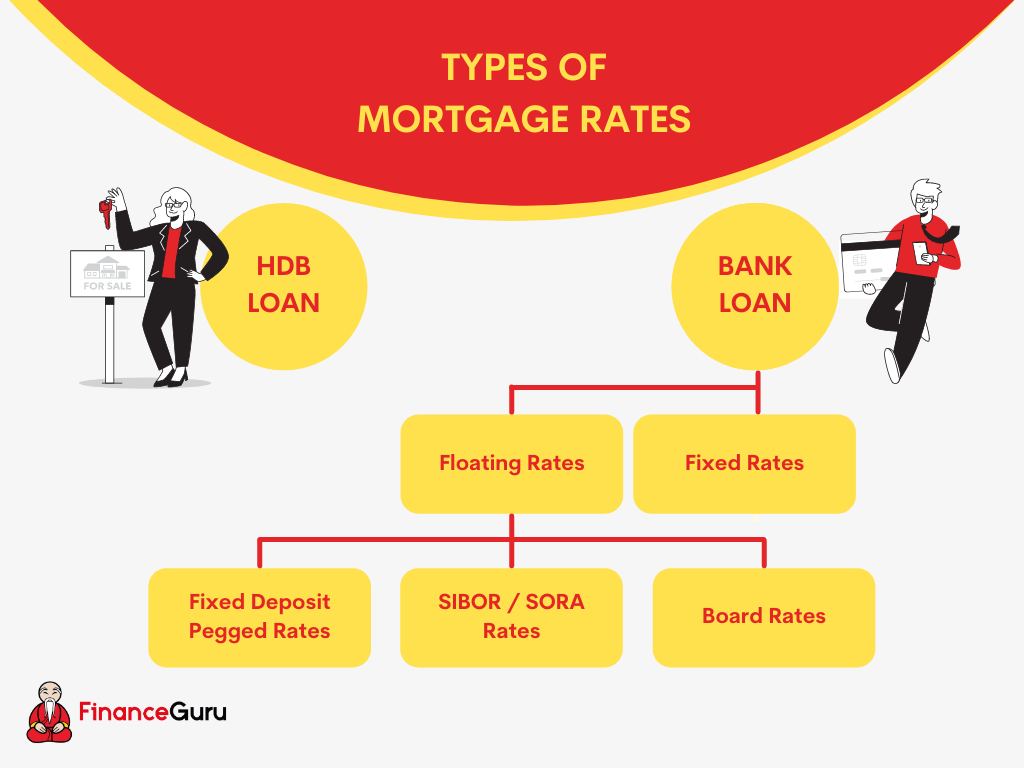

Taking up a mortgage loan for your property but feeling uncertain as to which rate to opt for? Read on to find out about the different types of mortgage rates. Here’s an overview:

HDB loan

The HDB loan is only applicable for HDB flats and is pegged to our CPF Ordinary Account interest rate + 0.1%.

As the CPF Ordinary Account interest rate is 2.5%, the HDB Loan Interest Rate is currently 2.6%. In fact, the HDB Loan Interest Rate has been at the same interest rate for the past 16 years.

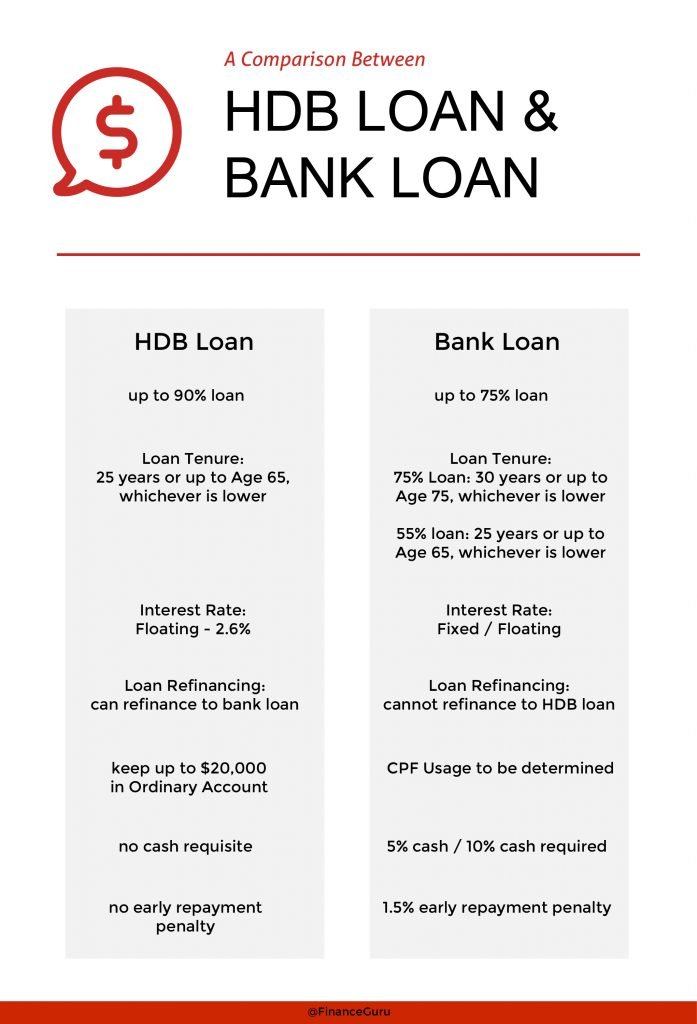

Read more about HDB loan vs bank loan here.

Bank loan

If you’re purchasing a private property, you have to take a bank loan. You’ll thus have to face the dilemma of deciding between fixed-rate and floating rates.

Fixed rates

As the word ‘fixed’ suggests, fixed rates are very stable. Regardless of fluctuations in interest rates, you’ll still be paying the same amount.

This means that you wouldn’t need to break into a sweat should interest rates in Singapore suddenly rise rapidly. Of course, the trade-off for this extra stability is that fixed-rate mortgage rates are usually higher than floating rates.

Some people are risk-averse and don’t mind paying higher mortgage interest rates for peace of mind. If you belong to this group of consumers, you should definitely pick fixed rates over floating rates.

Floating rates

If you prefer to go for floating rates, you’ll be stuck in another predicament. Should you go for SIBOR-pegged rates? Fixed deposit-pegged rates? Or board rates?

SIBOR-pegged rates

SIBOR (Singapore Interbank Offered Rate) determines the interest rates in Singapore, which follows closely with the United States’ interest rates.

This means that it’s volatile and highly dependent on interest rate movements in the United States.

Under the 3-month SIBOR rate, the rate that you pay will be ‘locked in’ for 3 months and renewed at the end of 3 months.

The same goes for the 1-month SIBOR rate — the rate you pay will be ‘locked in’ for 1 month and renewed at the end of the month.

Nonetheless, as SIBOR pegged rates are published for all to see, it’s the most transparent of all mortgage rates.

Here’s a comparison between the SIBOR rates in 2019 and 2020:

2019

| Month | 1M SIBOR | 3M SIBOR | 12M SIBOR |

|---|---|---|---|

| Jan 2019 | 1.765 | 1.886 | 2.124 |

| Feb 2019 | 1.771 | 1.891 | 2.124 |

| Mar 2019 | 1.823 | 1.949 | 2.154 |

| Apr 2019 | 1.826 | 1.944 | 2.125 |

| May 2019 | 1.823 | 1.944 | 2.125 |

| Jun 2019 | 1.886 | 2.005 | 2.186 |

| Jul 2019 | 1.884 | 2.001 | 2.186 |

| Aug 2019 | 1.882 | 1.886 | 2.126 |

| Sep 2019 | 1.876 | 1.879 | 2.124 |

| Oct 2019 | 1.872 | 1.877 | 2.122 |

| Nov 2019 | 1.797 | 1.803 | 2.092 |

| Dec 2019 | 1.746 | 1.769 | 1.965 |

2020

| Month | 1M SIBOR | 3M SIBOR | 12M SIBOR |

|---|---|---|---|

| Jan 2020 | 1.749 | 1.774 | 1.967 |

| Feb 2020 | 1.686 | 1.714 | 1.963 |

| Mar 2020 | 1.582 | 1.630 | 1.874 |

| Apr 2020 | 0.988 | 0.999 | 1.261 |

| May 2020 | 0.568 | 0.828 | 1.208 |

| Jun 2020 | 0.248 | 0.559 | 1.029 |

| Jul 2020 | 0.254 | 0.553 | 0.967 |

| Aug 2020 | 0.250 | 0.438 | 0.875 |

| Sep 2020 | 0.250 | 0.406 | 0.812 |

| Oct 2020 | 0.250 | 0.406 | 0.812 |

| Nov 2020 | 0.250 | 0.406 | 0.812 |

| Dec 2020 | 0.250 | 0.406 | 0.812 |

SORA

SORA is the volume-weighted average rate of unsecured overnight interbank SGD transactions brokered in Singapore.

While Singapore has transitioned from SOR to SORA, the transition phase for SIBOR to SORA will be spread over 3 to 4 years until the end of 2024.

Find out more about SORA replacing SIBOR here.

Fixed deposit-pegged rates

Fixed deposit pegged rates are pegged against the fixed deposit rates of the bank.

With the introduction of investment options such as the Singapore Savings Bond, consumers are shying away from depositing cash with the banks. Instead, they’re putting their money in these bonds.

As the banks’ pool of money diminishes, the banks will naturally increase their fixed deposit rates to incentivise consumers to park their money with them.

This would inadvertently hurt your mortgage rates.

Furthermore, fixed deposit pegged rates offer little transparency as the banks can change their rates as they deem fit.

Board rates

Board rates fare the worst in terms of transparency.

These rates are internally determined by the banks and are not pegged against any reference rates. Banks can have multiple board rates within their portfolio

Consumers have no indication of how rates are decided or how rates will change — the perfect illustration of imperfect information.

Having gone through the various types of mortgage rates, the question remains. Which is the best? We can say that it all boils down to what you want and which suits you best.

See how you can optimise your home loan refinance in a low-home interest rate environment here.

Learn more about loan jargons in this article here.

Got your Letter of Offer? We breakdown the terms in this article.

If you have any further queries, feel free to contact us for a chat. Here at FinanceGuru, we seek to help you better prepare for your finances and the upcoming milestones in your life. Get a non-obligatory assessment and loan product recommendations here.